Tax Benefits

Donations to Kobe University are eligible for tax benefits when you file a tax return.

The following two projects allow individual donors to receive a tax credit in addition to a tax deduction.

・Funding of scholarships for students who have difficulty in studying and living due to economic circumstances.

・Funding of reasonable accommodation for students with disabilities.

・Supporting research conducted by students and researchers in precarious employment.

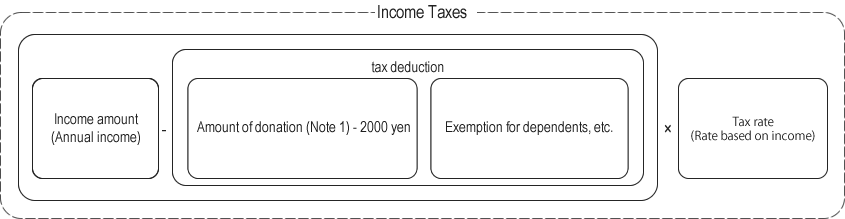

After the income deductions, the tax rate is multiplied to calculate the amount of income tax. If the donation amount is large compared to the amount of income, the tax reduction effect will be larger than the tax credit.

Total amount of donations for the year (Note 1) - 2,000 yen = Deduction for donations ⇒ Deduction from taxable income

Example: If the donation is 50,000 yen (for a person with an income of 7 million yen), the tax reduction will be approximately 11,000 yen.

(Note 1) If the total amount of your annual donation exceeds 40% of your annual gross income, the limit is the amount equivalent to 40%.

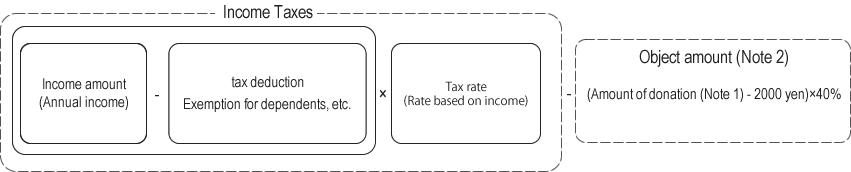

Applicable only to donations for study support projects (i.e., Support program for students who have difficulty in studying due to financial reasons) (The donor can choose either income tax deduction or tax credit.)

(Total amount of donations for the year (Note 1) - 2,000 yen) x 40% = Deduction for donations (Note 2) => Deduction from income tax.

Example: Tax reduction for a donation of 50,000 yen: (50,000 yen (Note 1) - 2,000 yen) x 40% = 19,200 yen (Note 2)

(Note 1) If the total amount of your annual donation exceeds 40% of your annual gross income, the limit is the amount equivalent to 40%.

(Note 2) The amount of deduction for donations is limited to 25% of the amount of income tax.

Residents of prefectures and municipalities (Hyogo Prefecture,Kobe City) that designate Kobe University as a corporation eligible for the deduction of donations by ordinance can receive a deduction for individual inhabitant tax. The maximum deduction rate is 10% for both prefectures and municipalities. Please refer to the Ministry of Internal Affairs and Communications website (Outline of the individual inhabitant tax donation taxation system) for detailed deduction rates.

※If you wish to receive only a deduction for donations for individual inhabitant tax purposes, please file a report with your local government.

We will send you a "Donation Receipt" after confirming your payment. Please keep the donation receipt in a safe place as it will be required for your tax return. (If you donate to the School Education Support Project, we will send you a receipt for your donation to this projectand a copy of the certificate for tax deduction purposes.)

Please note that if you pay by credit card after November, your receipt may be dated for the following year, in which case your donation deduction will also be for the following year.

The entire amount of the donation can be included in deductible expenses.